Real estate property is among the preferred selections between SDIRA holders. That’s mainly because you'll be able to put money into any kind of housing with a self-directed IRA.

IRAs held at banks and brokerage firms present confined investment options to their shoppers since they don't have the know-how or infrastructure to administer alternative assets.

Certainly, real estate is among our shoppers’ most widely used investments, in some cases called a housing IRA. Shoppers have the choice to invest in every thing from rental properties, professional real estate property, undeveloped land, mortgage loan notes and even more.

Irrespective of whether you’re a money advisor, investment issuer, or other economical Qualified, investigate how SDIRAs could become a strong asset to mature your small business and accomplish your Experienced targets.

Often, the charges related to SDIRAs is usually better and more sophisticated than with an everyday IRA. It is because in the enhanced complexity linked to administering the account.

No, You can't invest in your own small business that has a self-directed IRA. The IRS prohibits any transactions amongst your IRA as well as your own small business since you, given that the operator, are viewed as a disqualified individual.

Contrary to shares and bonds, alternative assets tend to be harder to offer or can have strict contracts and schedules.

Lots of investors are amazed to find out that working with retirement funds to take a position in alternative assets has been attainable because 1974. Even so, most brokerage firms and banking find out companies concentrate on giving publicly traded securities, like shares and bonds, because they lack the infrastructure and experience to control privately held assets, including go to my blog property or private fairness.

The leading SDIRA regulations through the IRS that investors need to be familiar with are investment constraints, disqualified individuals, and prohibited transactions. Account holders must abide by SDIRA procedures and polices in order to protect the tax-advantaged standing in their account.

Right before opening an SDIRA, it’s important to weigh the likely advantages and drawbacks based upon your particular money objectives and chance tolerance.

However there are plenty of Gains affiliated with an SDIRA, it’s not with out its possess disadvantages. A number of the typical reasons why investors don’t pick SDIRAs consist of:

Incorporating money on to your account. Bear in mind contributions are subject matter to annual IRA contribution boundaries established with the IRS.

Larger Fees: SDIRAs normally come with better administrative fees compared to other IRAs, as sure components of the executive procedure cannot be automatic.

This involves knowing IRS polices, handling investments, and avoiding prohibited transactions that may disqualify your IRA. An absence of knowledge could bring about high-priced problems.

Therefore, they have a tendency not to promote self-directed IRAs, which offer the flexibleness to invest inside of a broader range of assets.

Ease of Use and Engineering: A consumer-friendly System with on-line applications to trace your investments, submit paperwork, and control your account is essential.

Increased investment selections usually means you can diversify your portfolio beyond shares, bonds, and mutual money and hedge your portfolio towards marketplace fluctuations and volatility.

SDIRAs will often be utilized by palms-on buyers who are ready to tackle the risks and duties of selecting and vetting their investments. Self directed IRA accounts will visit this site right here also be perfect for investors who may have specialised awareness in a niche marketplace they want to put money into.

When you’re seeking a ‘established and forget about’ investing system, an SDIRA likely isn’t the right choice. As you are in overall Regulate in excess of just about every investment made, It really is your decision to carry out your own due diligence. Recall, SDIRA custodians are not fiduciaries and can't make suggestions about investments.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Heath Ledger Then & Now!

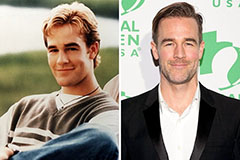

Heath Ledger Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!